All business owners are responsible for maintaining payroll records on behalf of each employee. This includes documentation detailing how wages are determined, payroll taxes , and more. But why is it so important that you hold onto them?

There are federal and state laws that require employers to keep payroll records for several years. The main purpose of keeping payroll files for each employee is to remain in compliance with regulatory bodies like the Internal Revenue Service (IRS) and the U.S. Department of Labor (DOL). However, maintaining detailed payroll records for several years can also benefit your business directly. Payroll records can be used to make decisions about raises, protect your business against claims of unfair or incorrect payment, and more.

To protect your business, use this guide to payroll records, so you know what’s required of you. Use the links below for quick answers to your questions.

Payroll records is a blanket term that applies to all documentation associated with paying employees , from hiring documents and direct deposit authorization forms to paystubs . This includes anything that documents total hours worked, their pay rate, tax deductions, employee benefits , etc.

In accordance with the Fair Labor Standards Act (FLSA), employers are required to keep most payroll records for at least 3 years . This law applies regardless of employment status, including both exempt and non-exempt employees .

First and foremost, holding on to payroll records is required by law . In order to remain in compliance with these laws and regulations, including those set forth by the FLSA and The Equal Employment Opportunity Commission (EEOC), you need to keep payroll files for each and every employee.

Payroll record retention is also important for business purposes. Payroll records are useful for tracking expenses, providing proof to back up payroll calculations, and documentation of employee background for reference when planning raises. Payroll files are an essential facet of employee records.

In addition to employee-related matters, keeping your payroll records can also be beneficial when it comes to your taxes. In case of an IRS audit, you’ll want to have payroll files on hand to back up any claims made on your income taxes.

On the federal level, there are several key pieces of legislation that you should be familiar with . This includes both the FLSA and Age Discrimination in Employment Act of 1967 (ADEA). Under the FLSA requirements for payroll, records must be kept on hand for 3 years. They also set requirements for what information must be included, and that timekeeping must be complete and accurate.

The Age Discrimination in Employment Act of 1967 (ADEA) also requires that payroll records be kept for 3 years. The Equal Employment Opportunity Commission (EEOC) also enforces labor laws, including that you must hold on to employment records for at least 1 year.

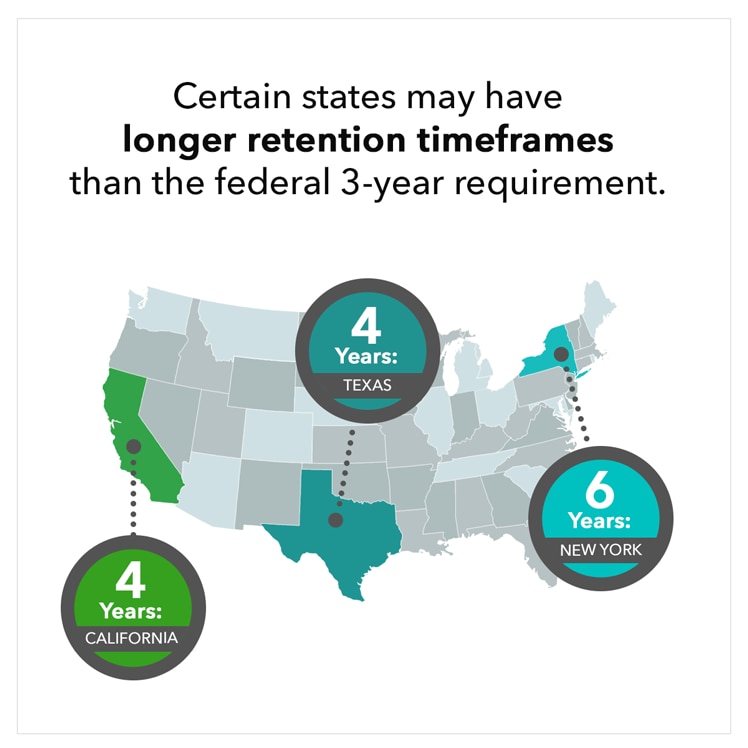

It’s important to note that state requirements may differ from one another, so you should research the laws that may pertain to your business. This is essential to keeping your business in compliance with regulating authorities, as many states require you to keep payroll records for longer.

For example, in New York , businesses are required to keep payroll records for 6 years instead of 3 years. In California and Texas , employers must retain payroll records for at least 4 years. As you can see, laws vary significantly state by state.

What should be included in payroll records?

While there is no requirement for how your payroll records are formatted and stored, there is specific information that needs to be included . When compiling your employee payroll records, make sure to include the following details:

Use this checklist when creating your template for payroll records to ensure that you have the required information in every payroll file. This will also help you ensure that you have standardized payroll records for every employee.

Your business is required by law to keep payroll records for a certain number of years. How long you need to keep records depends on the laws pertaining to that type of documentation.

The FLSA requires that businesses keep payroll records for at least 3 years . In addition to official payroll records, you must also keep any documentation that verifies how you determined an employee’s wages for at least 2 years. And don’t forget about documentation for employment taxes, also known as payroll taxes. The IRS requires you to keep these records for at least 4 years.

Once you fulfill the required retention timeline, you should dispose of payroll records. But that doesn’t mean you simply throw them away. Since highly sensitive information is kept within payroll files, it is important to properly dispose of them.

As with all other human resources records, payroll records should be thoroughly shredded and discarded in a secure location if they are paper documents. For digital files, permanently delete the file.

While payroll records have been traditionally stored in filing cabinets, businesses are increasingly going digital with their payroll files. When storing payroll records digitally, it’s essential that you use a secure solution to prevent this sensitive data from landing in the wrong hands .

Storing payroll records is a lot of responsibility, and should be done carefully. To help you stay organized and keep this information secure, here are some tips for storing payroll files:

For help managing and keeping track of your payroll records, QuickBooks payroll services can also be a helpful tool. With QuickBooks, you can automate the majority of the payroll process , generate payroll reports instantly, and rest assured that your data is safe.

Certified payroll records detail employees’ earnings, benefits, and hours worked on government projects. Certified payroll records need to be kept between 2 to 4 years , depending on the specific type of documentation. For example, payroll sheets need to be kept for 4 years, while time and attendance cards only need to be kept for 2 years.

In accordance with EEOC regulations , payroll records must be kept for at least one year—this includes terminated individuals. However, the FLSA requires that you keep payroll records for all employees for three years following the date of their termination.

Recommended for you

How to manage payroll as a small business

November 17, 2020

DIY accounting: How to calculate payroll

January 23, 2020

Payroll services for startups in 2023

December 18, 2020

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.